does utah have an estate or inheritance tax

Please contact us at 801-297-2200 or taxmasterutahgov for more information. According to the Oregon Department of Revenue the tax is called the Oregon Estate Transfer Tax.

If You Agreed To Bad Terms In Your Divorce Settlement You Will Get Screwed Utah Divorce Divorce Lawyers Divorce Attorney

The Utah State Tax Commission says this on its website.

. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax. Minnesota has an estate tax for any assets owned over 2700000 in 2019. Utah is a friendly tax state you need to make sure that you identify income tax rates real estate and sales.

Even though Utah has no estate tax there is still a federal estate tax that you have to take care of. The federal government may impose some tax on your property when you die. The rates of tax in Minnesota on amounts over 2700000 are between 13 16.

Friday February 21st 2020 207 pm. If you live in Oregon you can be happy that you dont have to pay both an estate tax and inheritance tax like people in Maryland. Since there is no longer a federal credit for state death taxes on the federal estate tax return.

Many people who are Estate Planning or have had someone die usually have questions about Michigan Inheritance Tax and if they have to pay it. Call 801 438-2022. Washington states 20 percent rate is the highest estate tax rate in the nation.

The only tax that needs to be worried about is federal taxes and any outstanding personal taxes that may need to be paid out of the estate. Arizona does not impose an inheritance tax but some other states do. A On and after July 1 2014 there shall be no estate taxes levied by the state and no estate tax returns shall be required by the.

Utah does not have an estate or an inheritance tax. However there is still a federal estate tax that applies to estates above a certain value. Utah does not have a state inheritance or estate tax.

Utahs estate tax system is commonly referred to as a pick up tax. And if you inherit property from another state that state may have an estate tax. The top estate tax rate is 16 percent exemption threshold.

The inheritance tax applies to money after it has been passed on to beneficiaries who are responsible for paying the tax. Utah does have an inheritance tax but it is what is known as a pick-up tax. A federal estate tax is in effect as of 2021 but the exemption is significant.

Most states dont levy an inheritance tax including Utah. Utah does not have a state inheritance or estate tax. This means that the amount of the Utah tax is exactly equal to the state.

However there is a Federal Estate Tax that your. While a few states require beneficiaries to pay taxes based on the value of their. Moreover the tax is paid by the beneficiary after the assets have been transferred out of the estate.

Inheritance tax of up to 15 percent. Utah Inheritance and Gift Tax. Does Georgia have an estate tax.

En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year. There is no inheritance tax in Utah. Probate ADVANCE Apply Now 1-800-959-1247.

Federal estate tax. Utah does not have a state inheritance or estate tax. Maryland imposes the lowest top rate at 10 percent.

Explanation of Utah estate or inheritance tax gift tax credit shelter trust and more. Note that if you leave everything to your spouse there is no estate. The absence of inheritance tax and estate tax in Utah does not apply to properties inherited from another state that may have such taxes.

An inheritance tax on the other hand is a tax imposed only on the value of assets inherited from an estate by a beneficiary. The only tax that needs to be worried about is federal taxes and any outstanding personal taxes that may need to be paid out of the estate. The short answer is no.

Utah does not collect an estate tax or an inheritance tax. 48-12-1 was added to read as follows. The inheritance tax is different from the estate tax.

Utah does not have an estate or an inheritance tax. 117 million increasing to 1206 million for deaths that occur in 2022. 805 Oakwood Dr Ste 125 Rochester MI 48307.

The Utah Trust Estate Educational Resource Center. Federal changes phased out the national inheritance tax and therefore eliminated Utahs inheritance tax after December 31 2004. Ogden and many more.

On the other hand you may owe an estate tax and the threshold of 1 million is relatively low. There is always an exemption for the federal tax for property worth 18 million or more. Utah does have an inheritance tax but it is what is known as a pick-up tax.

This exemption also applies to a married couple who can handle up to 2236. What does this mean for you if you inherit money in Utah. Prior taxable years not applicable.

This exemption also applies to a married couple who can handle up to 2236 million. An inheritance tax is a tax levied by a state government on a beneficiary or heir who inherits assets from an estate. Maryland is the only state to impose both.

Estate Tax - FAQ. Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent. Estate tax of 10 percent to 20 percent on estates above 22 million.

Skip to content 248 613-0007. Utah does not collect an estate tax or an inheritance tax. Return to Tax Listing.

Eight states and DC are next with a top rate of 16 percent. 4 The federal government does not impose an inheritance tax. Since there is no longer a.

Skip to content 248 613-0007. However a beneficiary who lives in another state may have to pay inheritance tax if the beneficiarys state of residence charges an inheritance tax even though the estate is administered in Utah. Impose estate taxes and six impose inheritance taxes.

Friday February 21st 2020 207 pm. Using the above example imagine that Jose was a resident of a state with an inheritance tax and that he bequeathed. As of July 1st 2014 OCGA.

Two states match the federal exemption level of 112 million. Maryland imposes the lowest top rate at. Additionally the State of Michigan does not have an Estate Tax either.

As a result beneficiaries or heirs who reside in Arizona do not pay an inheritance tax but beneficiaries or heirs who reside in another state may be subject. Twelve states and Washington DC. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. However state residents must remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1206 million in 2022 2412 million for couples. This is because Utah picks up all or a portion of the credit for state death taxes allowed on the federal estate tax return federal form 706 or 706NA.

Only estates that reach a legally defined threshold are subject to the estate tax. Is inheritance taxable in utah. Elimination of estate taxes and returns.

The Oregon Estate Tax. This means that if you have 3000000 when you die you will get taxed on the 300000 over the 2700000 exemption. We regularly help residents of the following cities in Utah.

TC-44R not currently available Statutes. Utah does not levy an inheritance tax.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

A Guide To Inheritance Tax In Utah

Estates And Trust Services Tax Lawyer Inheritance Tax Divorce Attorney

Utah Estate Tax Everything You Need To Know Smartasset

Utah State Income Tax Calculator Community Tax

Utah Estate Tax Everything You Need To Know Smartasset

A Guide To Inheritance Tax In Utah

Why You Need A Prenuptial Agreement Prenuptial Agreement Divorce Lawyers Prenuptial

Capital Gain Tax In The State Of Utah What You Need To Know Capital Gains Tax Capital Gain Education Savings Account

Historical Utah Tax Policy Information Ballotpedia

Utah Estate Tax Everything You Need To Know Smartasset

Utah Estate Inheritance Tax How To Legally Avoid

Utah Protective Orders And Divorce Child Custody Family Law Attorney Attorneys

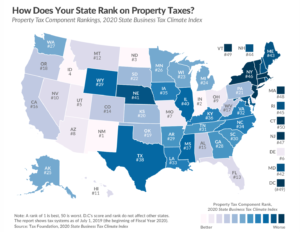

Utah S Property Taxes Continue To Be Recognized As One Of The Best In The Nation Utah Taxpayers

Child Support Lawyers Salt Lake City Child Support Family Law Attorney Child Custody

Cybersquatting Law 801 676 5506 Free Consultation Intellectual Property Lawyer Business Lawyer Divorce Lawyers

Why You Need A Will Probate Divorce Lawyers Attorneys

Utah Inheritance Laws What You Should Know

Utah Probate Filing Fees Probate Family Law Attorney Divorce Lawyers