rhode island tax table 2021

In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by the. Income tax rate schedule.

Estate Tax Rates Forms For 2022 State By State Table

More about the Rhode Island Tax Tables We last updated Rhode.

. The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375 to a high of 599. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet. The Division of Taxation has posted the income tax rate schedule for 20 22 that will be used by.

Exemption Allowance 1000 x Number of Exemptions. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing. The federal gift tax has an exemption of 15000 per person per year in 2021.

Any income over 150550 would be. This is a downloadable Excel spreadsheet withholding calculator tax tables all-in-one for the 2021-22-23 yearsThe tax instalment rates for 2022-23 applying from 1 July 2022 remain. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet.

However if Annual wages are more than 221800 Exemption is 0. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. Find your income exemptions 2.

Apply the taxable income computed in step 5 to the following. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. Find your pretax deductions including 401K flexible account.

Please use the link below to download 2021-rhode-island-tax-tablespdf and you can print it directly from your computer. DO NOT use to. Rhode Island State Income Tax Tax Year 2021 11 - Contents Contents Rhode Island Tax Rates Rhode Island Tax Calculator Tax Deductions Filing My Tax Return Rhode Island Tax Forms.

2021 RI Tax Tables_Multixls RHODE ISLAND TAX RATE SCHEDULE 2021 CAUTION. The state income tax table can be found inside the Rhode Island. 2022 Rhode Island Sales Tax Table.

RHODE ISLAND TAX RATE SCHEDULE 2021 CAUTION. More about the Rhode Island Tax Tables Individual Income Tax TY 2021 We last updated the Income Tax Tables in January 2022 so this is the latest version of Tax Tables fully updated. Personal Income Tax Tables 2021 Personal Income Tax Tables PDF file less than 1 mb megabytes.

Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. RI-1040H 2021 2021 RI-1040H Rhode Island Property. The state does tax Social Security benefits.

Rhode Island Division of Taxation - Page 3 of 5. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all DO NOT use. Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7.

To estimate your tax return for 202223 please select the 2022. RI Schedule CR 2021. The Rhode Island State Tax Calculator RIS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223.

Enter your financial details to. Start by finding your taxable estate bracket. The average effective property tax rate in Rhode Island is the 10th-highest in the country though.

How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table 1. Rhode Island Tax Brackets for Tax Year 2021 As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. The full list of rates can be found in the table below.

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Golocalprov Coalition Led By Unions Launching Campaign To Increase Tax On Top 1 In Rhode Island

Rhodes On The Pawtuxet Home Facebook

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

Cost Of Living In Rhode Island Ultimate Guide For 2022

Rhode Island Child Support Laws Recording Law

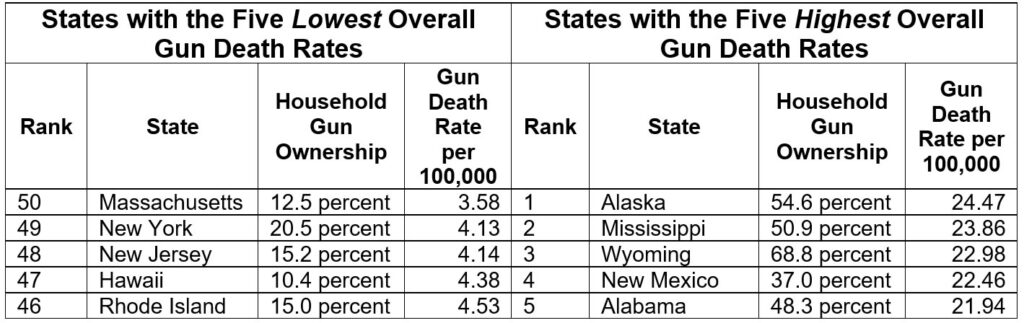

States With Strong Gun Laws And Lower Gun Ownership Have Lowest Gun Death Rates In The Nation New Data For 2019 Confirms Violence Policy Center

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Rhode Island Property Tax Calculator Smartasset

Consumer Alert Rhode Islanders Could Owe State Taxes On Unemployment Wjar

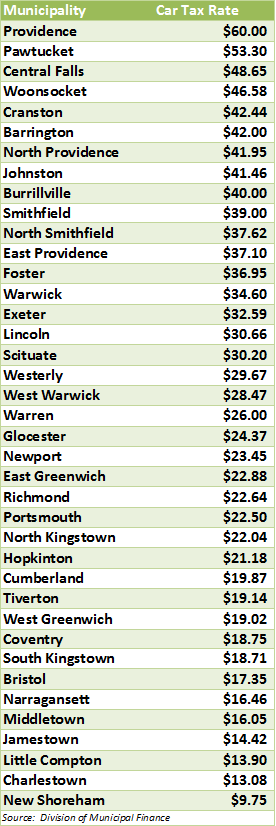

Golocalprov The Highest Car Taxes In Rhode Island

Best And Worst State Business Tax Environments 2021 The Tax Foundation

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Rhode Island State Tax Software Preparation And E File On Freetaxusa

Taxation Of Social Security Benefits Mn House Research

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc